UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

Bank of America Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Bank of America

Bank of America Corporation

2016

Proxy Statement

Annual Meeting of Stockholders

August 13, 2015March 17, 2016

Dear Fellow Stockholders:

On behalf of the Board of Directors, weWe cordially invite you to attend a Specialthe 2016 Annual Meeting of Stockholders, to be held on September 22, 2015,April 27, 2016 at 10:00 a.m., local time, inat the auditorium at 1 Bank of AmericaHilton Charlotte Center City, 222 East Third Street, Charlotte, North Carolina.

At the meeting we will discuss and vote on the mattermatters described in the notice and proxy statement. I also will provide a report on our company’s strategy and performance.

PleaseOn behalf of our Board of Directors, I would like to thank Charles K. Gifford, who is retiring as a director, for his years of service and contributions. Mr. Gifford is the former Chairman of our Board and serves as chair of our Board’s Credit Committee. We have greatly benefited from his judgment and experience.

Your vote is important; please read the enclosed proxy materialsdocuments with care and follow the voting instructions to ensure your views and shares are represented.represented at the meeting. We encourage you to vote and look forward to your participation.

On behalf of the Board, I would like to thank all of you for your continued investment and interest in our company.

Sincerely,

Brian T. Moynihan

Chairman and Chief Executive Officer

August 13, 2015

Dear Bank of America Stockholders:

On behalf of your Board and as fellow stockholders, we encourage your participation in the upcoming Bank of America Corporation Special Meeting of Stockholders. We are calling this Special Meeting to follow through promptly on the commitment the Board made prior to the 2015 Annual Meeting of Stockholders to seek input from all of you and ask you to ratify our ability to select a leadership structure that best serves the company’s needs and your interests.

In October 2014, we amended the company’s Bylaws to provide flexibility in considering the appropriate leadership structure for the Board as facts and circumstances may require. As discussed in the proxy statement for the 2015 Annual Meeting of Stockholders and in the enclosed proxy materials, we determined it currently is in the company’s and stockholders’ best interests to have Brian Moynihan serve as Chairman and Jack Bovender serve as Lead Independent Director—a new Board leadership role with robust powers and responsibilities to facilitate strong independent Board leadership. Since we established this governance structure, the Board has continued its diligent and active oversight of management, and we are confident this Board’s leadership structure serves the best interests of the company and all of us as stockholders by providing effective and efficient Board leadership while maintaining strong, independent oversight of management.

We undertook a thorough and thoughtful process before changing the company’s Bylaws, and, through our engagement with you, we have heard your desire to vote on this action. We now seek your support of our decision. We encourage you to read the attached proxy materials to understand why we believe you should ratify the Bylaw change.

We appreciate the candor with which you have shared your insights and perspectives with us and unanimously recommend that you vote “FOR” the proposal to ratify the October 2014 amendments to the company’s Bylaws. We will follow your voting decision.

Sincerely,

The Independent and Non-management Members of the Board

Jack O. Bovender, Jr.

Lead Independent Director

|  |

|

| |||

|

| |||||

|

|

|  | |||

|

| |||||

|

|

| ||||

|

|

|

Notice of Special2016 Annual Meeting of Stockholders

| Date: | ||

| Time: | 10:00 a.m., local time | |

| Place: |

| |

Item of Business: To vote on a proposalMatters to approve the following resolution:

Resolved, that the Bank of America Corporation stockholders hereby ratify the October 1, 2014 amendments to the company’s Bylaws that permit the company’s Board of Directors the discretion to determine the Board’s leadership structure, including appointing an independent Chairman, or appointing a Lead Independent Director when the Chairman is not an independent director.be voted on:

| l | Electing the 13 directors named in the proxy statement | ||

|

| l | A proposal approving our executive compensation (an advisory, non-binding “Say on Pay” resolution) |

| l | A proposal ratifying the appointment of our independent registered public accounting firm for 2016 |

| l | A stockholder proposal, if it is properly presented at our annual meeting |

| l | Any other business that may properly come before our annual meeting |

Record Date:date:Bank of America stockholders as of the close of business on August 10, 2015March 2, 2016 will be entitled to vote at this Special Meetingour annual meeting and any adjournments or postponements of the meeting.

Voting:Your vote is very important. Please submit your proxy as soon as possible by the Internet, telephone, or mail. Submitting your proxy by one of these methods will ensure your representation at the Special Meetingannual meeting regardless of whether you attend the meeting. Please refer to the following pagespage for information on how to vote your shares and attend our annual meeting.

By order of the Board of Directors:Directors,

Ross E. Jeffries, Jr.

Deputy General Counsel and Corporate Secretary

August 13, 2015March 17, 2016

Important Notice Regarding the Availability of Proxy Materials for the

Our Proxy Statement http://investor.bankofamerica.com |

Proxy StatementPROXY STATEMENT SUMMARY

We are providing or making available these proxy materials on or about August 13, 2015 to solicit your proxy to vote at a Special Meeting of Stockholders (the “Special Meeting”) to be held on September 22, 2015 at 10:00 a.m., local time,

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in the auditorium at 1 Bank of America Center, 150 North College Street, Charlotte, North Carolina 28202. In this proxy statement we referor in our corporate governance documents published on our website at http://investor.bankofamerica.com. We encourage you to Bank of America Corporation as “we,” “us,” “Bank of America” orread the “company” and the company’s Board of Directors as the “Board.”

The Board called this Special Meeting for stockholders to vote on a proposal (the “Proposal”) to approve the following resolution:proxy statement in its entirety before voting.

Resolved, that the Bank of America Corporation stockholders hereby ratify the October 1, 2014 amendments to the company’s Bylaws that permit the company’s Board of Directors the discretion to determine the Board’s leadership structure, including appointing an independent Chairman, or appointing a Lead Independent Director when the Chairman is not an independent director.

|

VOTING YOUR SHARES

Your vote is important. Please exercise your right as a stockholder and submit your proxy as soon as possible.

You may vote if you were a stockholder as of the close of business on August 10, 2015.March 2, 2016. Stockholders may vote in person at the meeting or submit a proxy by the Internet, telephone, or mail as follows:

| VIA THE INTERNET www.investorvote.com/bac (for registered holders) www.proxyvote.com (for beneficial owners) |   | BY MAIL Complete, sign, date, and return your proxy card in the envelope provided | |||

| BY TELEPHONE Call the phone number located on the top of your proxy card |

| IN PERSON Attend our | |||

If you submit your proxy via the Internet or by telephone, or over the Internet, you do not need to return your proxy card by mail.

If your shares are held beneficially through a bank, broker or other nominee in street name, you should follow the voting instructions provided to you by that entity or person.

| Proposals for Your Vote | Board Voting Recommendation | Page | ||

Proposal 1: Electing Directors | FOR each nominee | 1 | ||

Proposal 2: Approving Our Executive Compensation (an advisory, non-binding “Say on Pay” resolution) | FOR | 29 | ||

Proposal 3: Ratifying the Appointment of Our Independent Registered Public Accounting Firm for 2016 | FOR | 58 | ||

Proposal 4: Stockholder Proposal | AGAINST | 60 |

See “Voting and Other Information” on page 63 for more information on voting your shares.

ANNUAL MEETING ADMISSION

Annual meeting admission is limited to our registered and beneficial stockholders as of the record date and persons holding valid proxies from stockholders. Admission to our annual meeting requires proof of your stock ownership as of the record date and valid, government-issued photo identification. Security measures may include bag, metal detector, and hand-wand searches. The use of cameras, recording devices, phones, and other electronic devices is strictly prohibited. See “Attending our Annual Meeting” on page 65.

| BANK OF AMERICA CORPORATION |

| 2016 PROXY STATEMENT

|

i |

PROXY STATEMENT SUMMARY

2015 FINANCIAL AND OPERATING PERFORMANCE

Over the past several years, our company has undergone a strategic transformation. We have followed a strategy to simplify the company, rebuild our capital and liquidity, and invest in our company and our capabilities.

At the core of our strategy is the commitment we made to a clear purpose: to make financial lives better by connecting those we serve to the resources and expertise they need to achieve their goals. This is what drives us.

Bank of America has a straightforward model serving individual consumers, businesses of all sizes, and institutions. We made almost $16 billion in 2015 and returned nearly $4.5 billion to stockholders. We must build on that by growing within our stated risk limits, sustained by disciplined business practices and governance, by investing in our communities, and by being the best place to work for our employees.

– Brian Moynihan, Chairman and CEO

2015 Company Performance

Earned net income of $15.9 billion in 2015, versus $4.9 billion in 2014

Achieved record capital and liquidity levels

Tangible Common Equity of $162 billion, increased by $10.4 billion(1); Global Excess Liquidity Sources at $504 billion

Tangible book value per share increased8% to $15.62(1)

Continued focus on expenses while investing in growth

Excluding litigation, noninterest expense down 5%(1)

Improved/increased client and customer activity in all areas, including: business referrals (increased 19% to 5 million); total loans (grew nearly $22 billion); and deposits (increased $78 billion)

Strong asset quality discipline drove continued low levels of net charge-offs and declines in delinquencies and nonperforming loans

$4.5 billion returned to common stockholders through repurchases and dividends

Consumer Banking

| Best U.S. Consumer Franchise #1 retail deposit market share(2) | |||||

Global Wealth & Investment Management

| Top Wealth Management Brands #1 U.S. wealth management market position across client assets, deposits, and loans(3) | |||||

Global Banking

| Strong Global Banking Presence #3 in Global Investment Banking fees(4) | |||||

Global Markets

| Leader in Research #1 global research team five years in a row(5) |

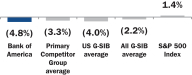

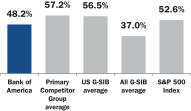

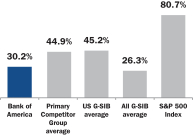

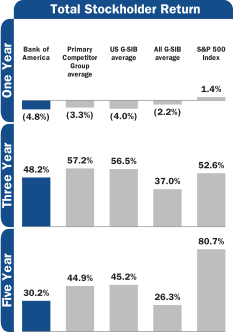

Total Stockholder Return(6)

| 1-year | 3-year | 5-year | ||

|  |  |

SUMMARY QUESTIONS & ANSWERSSee “Compensation Discussion and Analysis” on page 29 and our 2015 annual report.

SUMMARY QUESTIONS AND ANSWERS

This summary highlights information contained elsewhere in this proxy statement or in our corporate governance documents published on our website athttp://investor.bankofamerica.com. We encourage you to read this proxy statement in its entirety before voting.

The Board called this Special Meeting to ask stockholders to ratify the amendments made to our Bylaws in October 2014, which removed the requirement that the Chairman of the Board be an independent director and added provisions contemplating a Lead Independent Director (these amendments, as collectively set forth in Appendix A, the “Bylaw Amendment”). Shortly before our 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”), the Board committed to holding this ratification vote.

The Board’s leadership structure is critical to the proper functioning of the Board and its independent oversight of management and the company. In May 2015, the Board committed to hold this vote by the next annual meeting. The Board believes it is important to seek stockholders’ ratification of the Bylaw Amendment as soon as possible and not wait until the company’s 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”).

The Board believes that the optimal Board leadership structure for the company can and should change over time based on the company’s evolving needs, strategy and operating environment, the Board’s leadership needs and composition, and other factors, including the perspectives of stockholders and other stakeholders. The Board also believes that to best uphold its responsibility to the company and our stockholders, it should retain the flexibility to determine the Board leadership structure best suited to the company’s and Board’s then-existing circumstances and personnel.

Prior to 2009, our Bylaws did not require an independent Chairman of the Board. At our 2009 Annual Meeting of Stockholders, in the midst of the financial crisis and by a very close vote, stockholders voted to amend our Bylaws to require an independent director serve as the Board’s Chairman. Based on feedback from stockholders at that time and subsequently, the Board believes the 2009 vote for an independent Chairman primarily reflected concerns particular to Bank of America’s circumstances at that time, including dissatisfaction with the then Board’s governance and oversight, the company’s performance, and the then management’s strategic decisions prior to the 2009 stockholder vote, including the acquisitions of Countrywide and Merrill Lynch.

In 2014 the Board and its Corporate Governance Committee conducted an extensive review of Chairman succession planning as part of their ongoing consideration of the Board’s succession planning and leadership structure. The analysis included a review of the Board leadership structure that they believed would be the most effective for the Board at that time, and of the company’s then-current circumstances, which were quite different from those in 2009. In particular, the Board considered the company’s leadership needs and the positive developments at the company since 2009, including enhancements to the Board’s governance, significant changes to the Board’s composition (80% of the directors were not serving on the Board in 2009), changes to the company’s executive management team, and improvements in the company’s business and performance.

Based on that review, the Board determined to amend the Bylaws to remove the absoluterequirement for an independent Board Chairman and to permit the Board the flexibility in exercising its fiduciary duties and implementing a Board leadership structure that is most appropriate for the company at any given time, as circumstances may warrant. Equally important, the Board concurrently amended our Corporate Governance Guidelines to provide for a Lead Independent Director role with responsibilities that are more robust than industry norms to facilitate strong independent Board leadership. As part of these changes and in light of the then Chairman’s desire to transition out of that role, the Board implemented the leadership structure that it believes is most appropriate at this time and elected our CEO, Brian T. Moynihan, as Chairman, and the independent directors elected Jack O. Bovender, Jr. as Lead Independent Director.

| (4) | Source: Dealogic, as of January 5, 2016, for the quarter ended December 31, 2015. |

| (5) | Source: Institutional Investor magazine. |

| (6) | As of December 31, 2015. See page 42 for a list of the companies in our primary competitor group. “G-SIBs” are global systematically important banks designated by the Financial Stability Board as of November 3, 2015. |

ii | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

PROXY STATEMENT SUMMARY

COMPENSATION HIGHLIGHTS

Pay-for-Performance Compensation Philosophy

Our compensation philosophy ties our executive officers’ pay to company, line of business, and individual performance over the short and long term. Our executive compensation program provides a mix of salary, incentives, and benefits paid over time that we believe aligns executive officer and stockholder interests. A majority of total variable compensation granted to named executive officers is deferred equity-based awards, further encouraging long-term focus on generating sustainable results for our stockholders.

Our Compensation and Benefits Committee oversees a robust compensation risk management process that supports our enterprise risk management objectives through multiple checks and balances. We are focused on pay-for-performance, guided by our company’s strategy of responsible growth.

– Monica Lozano, Chair

Compensation and Benefits Committee

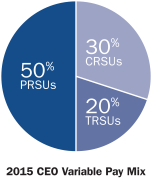

2015 Compensation Decisions for the CEO

For performance year 2015, the Compensation and Benefits Committee and the Board’s independent directors determined the following compensation for our CEO, in recognition of his individual performance and the overall performance of our company:

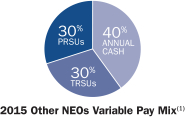

l Total compensation, inclusive of base salary and equity-based incentives, of $16 million l All CEO variable compensation awarded in equity (as it has been since 2010). Half of the CEO’s variable compensation was awarded in the form of performance restricted stock units (PRSUs). For PRSUs to have value, they must be re-earned by our company achieving specific performance goals overa three-year period (2016-2018) l The remainder of the CEO’s variable pay was awarded as 30% cash-settled restricted stock units (CRSUs) and 20% time-based restricted stock units (TRSUs) |  |

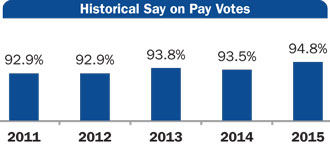

| Compensation Risk Management | Historical Say on Pay Votes | |||

l Mix of fixed and variable pay l Balanced, risk-adjusted performance measures l Pay-for-performance process that allocates individual awards based on actual results and how results were achieved l Review of feedback from independent control functions in performance evaluations and compensation decisions l Deferral of a majority of variable pay through equity-based awards l Use of multiple clawback and cancellation features for equity-based awards | Our Compensation and Benefits Committee believes the results of last year’s Say on Pay vote affirmed our stockholders’ support of our company’s executive compensation program. This informed our decision to maintain a consistent overall approach in setting executive compensation for 2015.

|

See “Compensation Discussion and Analysis” on page 29 and “Executive Compensation” on page 44.

BANK OF AMERICA CORPORATION |

| 2016 PROXY STATEMENT

|

| |||||||

PROXY STATEMENT SUMMARY QUESTIONS & ANSWERS

CORPORATE GOVERNANCE HIGHLIGHTS

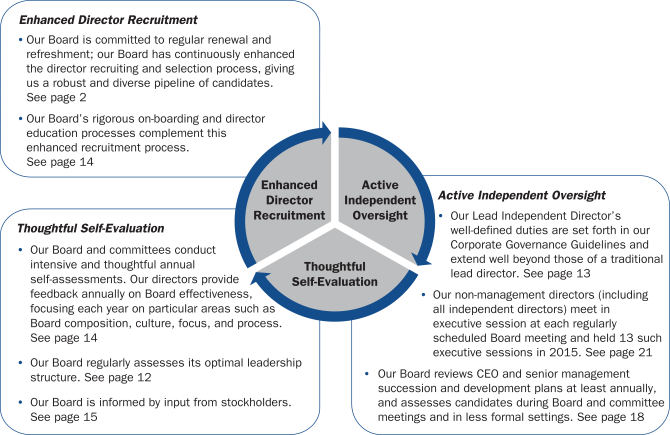

Thoughtful, Interconnected Practices

Strengthen Our Board’s Effectiveness

In adopting these changes,recent years, the Board concluded that an executive Chairman working togetherhas implemented a number of measures to improve Board composition, oversight, and effectiveness.

Our Board regularly reviews management’s strategy to create long-term value for stockholders and the progress our company is making. I’ve spent a great deal of time in 2015 and 2016 meeting with a Lead Independent Director empowered with strong, well-defined duties; amany of our investors. This engagement has been instructive to our Board consisting of experiencedas we continue to drive our company’s progress and committed directors, all but two of whomadd value to your investment. You are independent (except Mr. Moynihan and Charles K. Gifford); and Board committees that have strong independent committee chairs and members all provide forrepresented by a strong, independent Board leadership, effective engagement with diversity of experience and oversight of management,perspective, and a corporate governance structure that best serves the needs of the company, its stockholders and other stakeholders today.we welcome further dialogue with you.

–Jack Bovender, Lead Independent Director

Governance Enhancements Informed by Stockholder Input

| Our Board and management are committed to engaging with our stockholders. In 2015, our Board and management met with many of |

The Bylaw Amendment will be ratified, which will permit the Board the flexibility to determine the Board’s leadership structure that it believes will serve the company’s and stockholders’ best interests at any given time by providing effective and efficient Board leadership while maintaining strong, active and independent oversight of management. At least annually, the Board and the Corporate Governance Committee deliberates on and discusses the appropriate leadership structure of our Board based on the company’s needs. Until such time as the Board determines otherwise, it is expected that Mr. Moynihan will continue to serve as Chairman of the Board and Mr. Bovender as Lead Independent Director.

|

Unlike the 2009 amendment, the 2014 Bylaw Amendment does not impose a static Board leadership structure. The Board recognizes that leadership needs and its own composition will change over time. The Board will have the flexibility to assess the Board’s leadership needs in light of the then-existing facts and circumstances. At least annually, the Board and Corporate Governance Committee will evaluate our Board leadership structure and may appoint an independent Chairman depending on the company’s needs and circumstances, the Board’s leadership needs and composition, and the best interests of stockholders, the company and other stakeholders at that time.

The Board intends to promptly implement a plan to transition from the current Board leadership structure to an independent Chairman structure and reverse the 2014 Bylaw Amendment and the related 2014 amendments to the company’s Corporate Governance Guidelines. For the reasons stated in this proxy statement, the Board does not believe this outcome will be in the company’s or stockholders’ best interests.

The Board strongly believes that the Bylaw Amendment is in the best interests of the company and our stockholders. The Board unanimously recommends that stockholders vote “FOR” the Proposal to ratify the Bylaw Amendment. The Board believes that the Bylaw Amendment is in stockholders’ best interests because (a) it provides the Board flexibility to determine the best leadership structure for the company and its stockholders as needs and circumstances change, (b) there is no conclusive empirical evidence proving that a particular Board leadership structure produces superior corporate performance or best Board governance, (c) only a small minority of S&P 500 companies require the separation of the Chairman and CEO roles in all cases, (d) there are many successful and well managed U.S. public companies that do not have an independent chairman, and (e) a “one-size-fits-all” approach to Board leadership is excessively restrictive and does not take into account the differences among companies in board composition and changing needs of the company and the Board over time.

The Board believes that the company and its stockholders benefit from the Board’s adoption of strong corporate governance practices. These include:

|

|

|

|

iv | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

PROXY STATEMENT SUMMARY

RESPONSIBLE SUSTAINABLE GROWTH:

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE HIGHLIGHTS

We define sustainable growth through an environmental, social, and governance (ESG) framework, ensuring that we are growing the right way—from business policies and practices, to the way we treat our employees and manage our company.

Our ESG Committee, which is composed of members of senior management from every business line and support function, oversees our efforts in this area and routinely provides ESG reports to our Board’s Corporate Governance Committee. In 2015, our ESG performance was recognized by the Dow Jones Sustainability Index, where we were named to the World and North American Indices.

Our Corporate Governance Committee oversees our company’s ESG activities. We are very proud of the way the company integrates ESG into our business operations. It is not just an add-on or solely philanthropic—it is core to our company’s values, it is profitable, and it makes tremendous sense for our stockholders. – Tom May, Chair Corporate Governance Committee |

In addition to the corporate governance highlights summarized on the prior page, our recent ESG accomplishments include:

l Continued to foster a diverse and inclusive environment—more than 50% of our global workforce is female and more than 40% of our U.S.-based workforce is from a racially or ethnically diverse background l Began offering free FICO credit scores for online banking customers who have a Bank of America credit card. This further strengthens our existing suite of responsible financial products l Continued our leadership as the largest investor in Community Development Financial Institutions, with over $1.2 billion in credit extended l Continued to deliver local economic growth and development through more than $2 billion in spending with diverse suppliers |  | |

l Increased our environmental business initiative to provide $125 billion to low-carbon and other environmental businesses by 2025, including the continued growth of our Catalytic Finance Initiative and investments in clean energy projects around the globe l Issued our second Green Bond in a $600 million offering, and continued our role as the leading underwriter of Green Bonds in the industry l Reduced our greenhouse gas emissions by roughly one-third and our water consumption by more than 25% since 2010, as part of our overall focus on reducing the environmental impact of our operations |  | |

In 2016, we will continue to demonstrate our commitment to transparency by:

| l | Publishing a Business Standards Report about our corporate governance, our risk management and control functions, and how our relationships with customers and key stakeholders are deepening in ways that are unique to Bank of America |

| l | Publishing an Environmental and Social Risk Framework that details how we identify, measure, monitor, and control risks related to environmental and social issues |

See “ESG Initiatives: Focus on Responsible, Sustainable Growth” on page 17.

| BANK OF AMERICA CORPORATION |

| 2016 PROXY STATEMENT

|

v | ||||||

SUMMARY QUESTIONS & ANSWERSTABLE OF CONTENTS

29 | Proposal 2: Approving Our Executive Compensation (an advisory, non-binding “Say on Pay” resolution) | |

29 | ||

30 | ||

31 | ||

33 | ||

36 | ||

41 | ||

43 | ||

44 | ||

44 | ||

47 | ||

50 | ||

52 | ||

54 | ||

55 | ||

58 | Proposal 3: Ratifying the Appointment of Our Independent Registered Public Accounting Firm for 2016 | |

59 | ||

59 | ||

60 | Proposal 4: Stockholder Proposal | |

63 | ||

| A-1 |

|

|

|

|

|

|

|

|

|

|

|

|

The record date forPROXY STATEMENT

We are providing or making available this proxy statement to solicit your proxy to vote on the Special Meeting is August 10, 2015 (the “record date”). Accordingly,matters presented at our annual meeting. We commenced providing and making available this proxy statement on March 17, 2016. Our Board requests that you may vote atsubmit your proxy by the Special Meeting if you were a stockholder of record,Internet, telephone, or heldmail so that your shares beneficially throughwill be represented and voted at our annual meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

We mailed or emailed to most of our stockholders a Notice of Internet Availability of our proxy materials with instructions on how to access our proxy materials over the Internet and how to vote. If you are a registered stockholder and would like to change the method of delivery of your proxy materials, please contact our transfer agent, Computershare Trust Company, N.A., P.O. Box 43078, Providence, Rhode Island 02940-3078; Toll free: 800-642-9855; or atwww.computershare.com/bac. You may do the same as a beneficial stockholder by calling the bank, broker, or other nominee in street name as of the close of business on August 10, 2015.where your shares are held.

| 2016 PROXY STATEMENT |

In order

PROPOSAL 1: ELECTING DIRECTORS

PROPOSAL 1: ELECTING DIRECTORS

Our Board is presenting 13 nominees for election as directors at our annual meeting. Other than Mr. Woods, who is a new nominee identified by a third-party search firm, all nominees currently serve as directors on our Board and were elected by you at our 2015 annual meeting. After more than a decade of valuable service, Charles K. Gifford will retire at our annual meeting. Each director elected at the meeting will serve until our 2017 annual meeting or until a successor is duly elected and qualified. Each director nominee has consented to holdbeing named in this proxy statement and to serve as a director if elected. If any nominee is unable to stand for election for any reason, the shares represented at our Special Meeting, a quorum representing holders of a majority of the voting power ofannual meeting may be voted for another candidate proposed by our common stock, the Series B Preferred Stock and the Series 1Board, or our Board may choose to 5 Preferred Stock must be present in person or represented by proxy. We will count as present shares present in person but not voting and shares for which we have received proxies but for which holders thereof have abstained from voting. Broker non-votes, if any, will not be counted as shares present.reduce its size.

| Nominee/Principal Occupation | Age | Director Since | Independent | Other Public Company | Bank of America Corporation Board Committee | |||||||||||||

| Audit | Compensation and Benefits | Corporate Governance | Credit | Enterprise Risk | ||||||||||||||

Sharon L. Allen

Former Chairman, Deloitte LLP | 64 | 2012 | Yes | 1 | C | M | ||||||||||||

Susan S. Bies

Former Member, Board of Governors of the Federal Reserve System | 68 | 2009 | Yes | None | M | M | ||||||||||||

Jack O. Bovender, Jr.

Lead Independent Director, Bank of America Corporation; Former Chairman and CEO, HCA Inc. | 70 | 2012 | Yes | None | M | |||||||||||||

Frank P. Bramble, Sr.

Former Executive Officer, MBNA Corporation | 67 | 2006 | Yes | None | M | C | ||||||||||||

Pierre J.P. de Weck

Former Chairman and Global Head of Private Wealth Management, Deutsche Bank AG | 65 | 2013 | Yes | None | M | M | ||||||||||||

Arnold W. Donald

President and CEO, Carnival Corporation and Carnival plc | 61 | 2013 | Yes | 2 | M | M | ||||||||||||

Linda P. Hudson

Chairman and CEO, The Cardea Group, LLC; Former President and CEO, BAE Systems, Inc. | 65 | 2012 | Yes | 2 | M | M | ||||||||||||

Monica C. Lozano

Former Chairman, US Hispanic Media Inc. | 59 | 2006 | Yes | 1 | C | M | ||||||||||||

Thomas J. May

Chairman, President, and CEO, Eversource Energy | 69 | 2004 | Yes | 1 | C | M | ||||||||||||

Brian T. Moynihan

Chairman of the Board and CEO, Bank of America Corporation | 56 | 2010 | No | None | ||||||||||||||

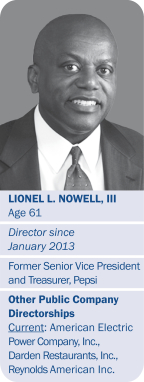

Lionel L. Nowell, III

Former SVP and Treasurer, PepsiCo, Inc. | 61 | 2013 | Yes | 3 | M | M | ||||||||||||

Thomas D. Woods

Former Vice Chairman and SEVP, Canadian Imperial Bank of Commerce | 63 | — | Yes | None | ||||||||||||||

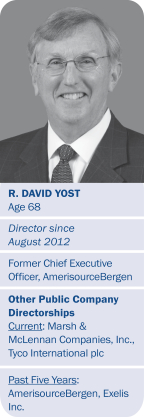

R. David Yost

Former CEO, AmerisourceBergen Corporation | 68 | 2012 | Yes | 2 | M | M | ||||||||||||

Number of Meetings Held in 2015(1)

| Board: 21 | 14 | 7 | 9 | 10 | 13 | ||||||||||||

C = Chair; M = Member

BANK OF AMERICA CORPORATION |

| |||||||

|

You may vote in person at our Special Meeting or by submitting your proxy by:PROPOSAL 1: ELECTING DIRECTORS

|

|

|

To be counted, your proxy must be received before the polls close at our Special Meeting. If your shares are held beneficially through a bank, broker or other nominee in street name, you should follow the voting instructions provided to you by that entity or person.

An overviewIDENTIFYING AND EVALUATING DIRECTOR CANDIDATES

Our Board believes our directors should have the qualifications, skills, personal qualities, and diversity of backgrounds that, when taken together, best serve our corporate governance practices cancompany and our stockholders. These individuals should possess personal integrity and character, demonstrated management and leadership ability, have extensive experience within our industry and across sectors, and be foundable to exercise their sound and independent judgment in the definitive proxy statement for our 2015 Annual Meeting, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 26, 2015. More information about our corporate governance can be found on our website athttp://investor.bankofamerica.coma collegial manner.

Our Board views diversity as a priority and seeks representation across a range of attributes, including race, gender, ethnicity, and professional experience, and regularly assesses our Board’s diversity when identifying and evaluating director candidates. Our Corporate Governance Committee follows applicable regulations in ensuring our Board includes members who are independent, possess financial literacy and expertise, and have experience in identifying, assessing, and managing risk exposures and/or understanding of risk management principles, policies, and practices. | Core Attributes | |||||||||

|

|

|

| |||||||

l Strong Business Judgment | ||||||||||

l Demonstrated Achievement in Public or Private Sectors | ||||||||||

l Proven Leadership and Management Ability | ||||||||||

l Dedicated; Able to Devote Necessary Time to Oversight Duties and Represent Stockholders’ Interests | ||||||||||

l Free of Potential Conflicts of Interests | ||||||||||

l Collegial Manner |

BACKGROUND OF THE PROPOSALOur Board seeks directors whose complementary knowledge, experience, and skills provide our company with a broad range of perspectives and leadership expertise in financial services and other highly complex and regulated industries, strategic planning and business development, business operations, marketing and distribution, risk management and financial controls, corporate governance and public policy, and other areas important to our company’s strategy and oversight. This effort is embodied in our current Board composition and by our 13 director nominees. See “Our Director Nominees” on the following page.

As part of this director recruitment process, the Committee has developed and is regularly reviewing a “pipeline” of director talent to consider for Board renewal and refreshment. The pool of candidates identified by the search firms is periodically refreshed to reflect currently available director talent and the Committee’s review and feedback. In 2015, the Committee used two external search firms to present candidates having professional experience aligned with criteria the Committee specified and with the experiential diversity needs our Board identified in its 2014 and 2015 self-assessments. See “Board Evaluation” on page 14 for additional information on our Board’s self-evaluation process.

underThe Committee has an established process for evaluating director candidates that it follows regardless of who recommends a candidate for consideration. Through its process, the heading “Corporate Governance,”Committee reviews available information regarding each candidate, including our: (a) Certificatequalifications, experience, skills, and integrity, as well as race, gender, and ethnicity. The Committee also confirms the candidate’s independence and absence of Incorporation; (b) Bylaws; (c)conflicts. In addition, the Committee adheres to our Corporate Governance Guidelines, (includingwhich provide that a director who has reached the age of 72 shall not be nominated for initial election to our Related Person Transactions Policy) and Director Independence Categorical Standards; (d) CodeBoard. However, the Board may nominate such an individual for re-election if, in light of Conduct and related materials; and (e) composition of eachcircumstances at the time, it finds such nomination to be in the best interests of our Audit, Compensationcompany and Benefits,its stockholders. Our director selection process has been reviewed and acknowledged by our primary bank regulators.

Any stockholder who wishes to recommend a director candidate for consideration by our Corporate Governance Credit and Enterprise Risk Committees, includingCommittee must submit a written recommendation to the committee charters, and in other materials found on our website. This information is also available in print, free of charge, upon written request addressed to our Corporate Secretary at Bank of America Corporation, Hearst Tower, 214 North Tryon Street, NC1-027-18-05, Charlotte, North Carolina 28255. For our 2017 annual meeting of stockholders, the Committee will consider recommendations received by October 15, 2016. The recommendation must include the information set forth in our Corporate Governance Guidelines, which are published on our website athttp://investor.bankofamerica.com.

BACKGROUND OF THE

2 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

PROPOSAL 1: ELECTING DIRECTORS

OCTOBER 1, 2014 BYLAW AMENDMENTOUR DIRECTOR NOMINEES

As previously disclosed,Our Board selected our 13 director nominees based on October 1, 2014, after careful deliberation,their high caliber and in lightdiverse array of our prior Chairman’s desire to transition out of the Chairman role, to allow for a smoothexpertise, experience, and timely transition of Board leadership and minimize disruption to investors, employees, and other stakeholders, the Board took prompt and decisive action to amend our Bylaws to remove the requirement that the Chairman of the Board be an independent director and adopt governance provisions contemplating a Lead Independent Director. In connection with the Bylaw Amendment, the Board elected Brian T. Moynihan, our CEO, to succeed Charles O. Holliday, Jr. as Chairman of the Board,skills, and the independent directors of the Board elected Jack O. Bovender, Jr.belief that each can make substantial contributions to serve in the newly established Lead Independent Director role. The Board determined at that time and continues to believe that the leadership structure of Mr. Moynihan as Chairman and CEO and Mr. Bovender as Lead Independent Director is in the best interests of Bank of America and its stockholders based on the company’s present needs and circumstances.

The Bylaw Amendment is summarized in more detail below.

our company.

| Range of Qualifications and Skills Represented by Our Nominees | ||

l Financial Services Experience l Strategic Planning l Operational Risk Management l Marketing and Retail Distribution l Leadership of Complex, Highly Regulated Businesses l Consumer, Corporate, and Investment Banking l Corporate Governance | l Cybersecurity Risk Management l Succession Planning l Business Development l Risk Management l Global Perspective l Public Company Board Service l Government, Public Policy, and Regulatory Affairs l Environmental, Social, and Governance (ESG) | |

Our nominees:

| l | are seasoned leaders who have held leadership positions in complex, highly regulated businesses (including banks and other financial services organizations) and with our primary regulator, and management roles as chief executives and in the areas of risk, operations, finance, technology, and human resources |

| l | bring deep and diverse experience in public and private companies, financial services, the public sector, nonprofit organizations, and other domestic and international businesses |

| l | are experienced in regulated, non-financial services industries, adding to our Board’s understanding of overseeing a business subject to governmental oversight, and enhancing the diversity of our Board with valuable insights and fresh perspectives that complement those of our directors with specific experience in banking or financial services |

| l | represent diverse viewpoints |

| l | strengthen our Board’s oversight capabilities by having varied lengths of tenure that provide historical and new perspectives about our company |

Of our 13 nominees:

| l |

| Hispanic, and | |||

The descriptionOur Board believes, in totality, that this mix of attributes among the Bylaw Amendment set forth above is qualifiednominees strengthens our Board’s independent leadership and effectiveness in its entirety by reference to the textlight of the Bylaw Amendment, which is attached as Appendix A to this proxy statement.our company’s businesses, our industry’s operating environment, and our company’s long-term strategy.

| BANK OF AMERICA CORPORATION |

| 2016 PROXY STATEMENT

| 3 |

PROPOSAL 1: ELECTING DIRECTORS

Our Board recommends a vote “FOR” each of the nominees

listed below for election as a director (Proposal 1).

Set forth below are each nominee’s name, age as of our annual meeting date, principal occupation, business experience, and U.S. public company directorships held during the past five years. We also discuss the qualifications, attributes, and skills that led our Board to nominate each for election as a Bank of America director.

| QUALIFICATIONS, ATTRIBUTES, AND SKILLS: l Ms. Allen’s responsibility for audit and consulting services in various positions with Deloitte LLP (Deloitte) provide her with extensiveaudit, financial reporting, and corporate governance experience l Her leadership positions with Deloitte give herbroad management experience with large, complex businesses and an international perspective on risk management and strategic planning Professional Highlights: l From 2003 until her retirement in 2011, Ms. Allen served as Chairman of Deloitte, a firm that provides audit, consulting, financial advisory, risk management, and tax services as the U.S. member firm of Deloitte Touche Tohmatsu Limited O She worked at Deloitte for nearly 40 years in various leadership roles, including partner and regional managing partner O She was responsible for audit and consulting services for a number of Fortune 500 and large private companies O She was also a member of the Global Board of Directors, Chair of the Global Risk Committee, and U.S. representative on the Global Governance Committee of Deloitte Touche Tohmatsu Limited from 2003 to 2011 l Ms. Allen serves on the board of a food and drug retailer seeking to become a public company under the name Albertsons Companies, Inc. Other Leadership Experience and Service: l Ms. Allen is a current director and former Chair of the National Board of Directors of the YMCA of the USA, a leading nonprofit organization for youth development, healthy living, and social responsibility l She served as Chair of the Audit Committee and as a board member of Catalyst Inc., a leading nonprofit organization dedicated to expanding opportunities for women and business l She was appointed by President George W. Bush to the President’s Export Council |

4 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT

|

PROPOSAL 1: ELECTING DIRECTORS

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | Ms. Bies’s role as a Federal Reserve System Governor and her tenure with First Tennessee National Corporation (First Tennessee) provide her with deep experience inrisk management, consumer banking, and financial regulation. In particular, Ms. Bies focused onenterprise financial and risk management during her career with First Tennessee and further developed herregulatory expertise by serving on the Financial Accounting Standards Board (FASB) Emerging Issues Task Force |

| l | Herexperience working at a primary regulator of our industry, along with her other regulatory and public policy experience, gives her a unique and valuable perspective relevant to our company’s business,financial performance, andrisk oversight |

| l | She brings aninternational perspective through her service on the boards of Zurich Insurance Group Ltd. (Zurich Insurance) and Merrill Lynch International (MLI) |

Professional Highlights:

| l | Ms. Bies has served as a Senior Advisory Board Member to Oliver Wyman Group, a management consulting subsidiary of Marsh & McLennan Companies, Inc., since February 2009 |

| l | She served as a member of the Board of Governors of the Federal Reserve System from 2001 to 2007. During her service, Ms. Bies was Chairwoman of the Committee on Supervisory and Regulatory Affairs; she also represented the Federal Reserve Board on the Financial Stability Board and led the Federal Reserve Board’s efforts to modernize the Basel capital accord |

| l | Ms. Bies served as a member of the FASB Emerging Issues Task Force from 1996 to 2001 |

| l | Ms. Bies held various leadership roles, including Executive Vice President of Risk Management, Auditor, and Chief Financial Officer at First Tennessee, a regional bank holding company where she was employed from 1979 to 2001. At First Tennessee, she also served as Chair of the Asset Liability Management and the Executive Risk Management Committees |

| l | Ms. Bies currently serves as a director of Zurich Insurance, where she chairs the Risk Committee |

| l | Ms. Bies chairs the board of our U.K. broker-dealer, MLI |

| l | She began her career as a regional and banking structure economist at the Federal Reserve Bank of St. Louis |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As a former Chairman, Chief Executive Officer, President, and Chief Operating Officer of HCA Inc. (HCA), Mr. Bovender hasextensive experience leading a large, regulated, complex business |

| l | Mr. Bovender’s experience with HCA and service on the Board of Trustees of Duke University, including as former Chair of its Audit Committee, provide him with insight intorisk management, operational risk, and strategic planning, and valuable perspective oncorporate governance issues |

Professional Highlights:

| l | Mr. Bovender served as Chairman of HCA, the largest investor-owned hospital, and a Fortune 100 company owning and operating hospitals and surgery centers, from January 2002 to December 2009, and was Chief Executive Officer from January 2001 to January 2009. During his tenure at HCA, he also served as President and Chief Operating Officer |

| l | Mr. Bovender began his career in hospital administration in the U.S. Navy |

Other Leadership Experience and Service:

| l | Mr. Bovender is Vice Chair of the Duke University Board of Trustees and previously served as Chair of its Audit Committee |

| l | He also serves on the Duke University Healthcare System’s Board of Directors |

BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT | 5 |

PROPOSAL 1: ELECTING DIRECTORS

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | Mr. Bramble bringsbroad-ranging financial services experience, international experience, and historical insight to our Board, having held leadership positions at two financial services companies acquired by our company (MBNA Corporation, acquired in 2006, and MNC Financial Inc., acquired in 1993) |

| l | As a former executive officer of one of the largest credit card issuers in the U.S. and a major regional bank, he has dealt with a wide range of issues important to our company, includingrisk management, credit cycles, sales and marketing to consumers, and audit and financial reporting |

Professional Highlights:

| l | Since July 2014, Mr. Bramble has served as Chairman of the Board of Trustees of Calvert Hall College High School (Baltimore, MD), where he served as Interim President from July 2013 to June 2014 |

| l | Mr. Bramble served as Vice Chairman, from July 2002 to April 2005, and advisor to the Executive Committee, from April 2005 to December 2005, of MBNA Corporation, a financial services company acquired by Bank of America in January 2006 |

| l | He previously served as the Chairman, President, and Chief Executive Officer at Allfirst Financial, Inc., MNC Financial Inc., Maryland National Bank, American Security Bank, and Virginia Federal Savings Bank |

| l | Mr. Bramble also served as a director, from April 1994 to May 2002, and Chairman, from December 1999 to May 2002, of Allfirst Financial, Inc. and Allfirst Bank, U.S. subsidiaries of Allied Irish Banks, p.l.c. |

| l | He began his career as an audit clerk at the First National Bank of Maryland |

Other Leadership Experience and Service:

| l | He is an emeritus member of the Board of Visitors of Towson University, where he was also a lecturer in accounting from 2006 to 2008 |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | Mr. de Weck’s experience as an executive with UBS AG (UBS) and Deutsche Bank AG (Deutsche Bank) provides him withextensive knowledge of the global financial services industry |

| l | As a former Chairman and Global Head of Private Wealth Management and member of the Group Executive Committee of Deutsche Bank, Mr. de Weck has broad experience inrisk management and strategic planning and brings a valuableinternational perspective to our company’s business activities |

| l | Mr. de Weck’s service as Chief Credit Officer of UBS provides him with furthercredit risk management experience |

Professional Highlights:

| l | Mr. de Weck served as the Chairman and Global Head of Private Wealth Management and as a member of the Group Executive Committee of Deutsche Bank from 2002 to May 2012 |

| l | Prior to joining Deutsche Bank, Mr. de Weck served on the Management Board of UBS from 1994 to 2001, as Head of Institutional Banking from 1994 to 1997, as Chief Credit Officer and Head of Private Equity from 1998 to 1999, and as Head of Private Equity from 2000 to 2001 |

| l | He also held various senior management positions at Union Bank of Switzerland, a predecessor firm of UBS, from 1985 to 1994 |

6 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

PROPOSAL 1: ELECTING DIRECTORS

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As President and Chief Executive Officer of Carnival Corporation and Carnival plc (Carnival), as a former senior executive at Monsanto Company (Monsanto), and as the former Chairman and Chief Executive Officer of Merisant Company (Merisant), Mr. Donald has extensive experience instrategic planning and operations in regulated, consumer, retail, and distribution businesses |

| l | His board service with public companies gives him experience withrisk management, global operations, and regulated businesses |

| l | His experience heading The Executive Leadership Council and the Juvenile Diabetes Research Foundation International gives him a distinct perspective ongovernance matters, social responsibility, and diversity |

Professional Highlights:

| l | Mr. Donald has been President and Chief Executive Officer of Carnival, a cruise and vacation company, since July 2013 |

| l | Mr. Donald previously served as President and Chief Executive Officer from November 2010 to June 2012 of The Executive Leadership Council, a nonprofit organization providing a professional network and business forum to African-American executives at major U.S. companies |

| l | Mr. Donald was President and Chief Executive Officer of the Juvenile Diabetes Research Foundation International from January 2006 to February 2008 |

| l | From 2000 to 2003, Mr. Donald served as Chairman and Chief Executive Officer of Merisant, a privately held global manufacturer of tabletop sweeteners, and he remained Chairman until 2005 |

| l | He joined Monsanto in 1977, where over his 20-year tenure he held several senior leadership positions with global responsibilities including President of its Agricultural Group and President of its Nutrition and Consumer Sector |

Other Leadership Experience and Service:

| l | Mr. Donald was appointed by President Clinton and re-appointed by President George W. Bush to the President’s Export Council |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As a former President and Chief Executive Officer of BAE Systems, Inc. (BAE), Ms. Hudson has broad experience instrategic planning and risk management |

| l | Further, with her service as an executive director of BAE Systems plc (BAE Systems), Ms. Hudson’s experience provides her withinternational perspective, geopolitical insights, and skill as aleader of a large, international, highly regulated, complex business |

| l | Ms. Hudson’s career in the defense and aerospace industry gives her knowledge oftechnology risks such ascybersecurity risk |

Professional Highlights:

| l | Ms. Hudson has served as Chairman and Chief Executive Officer of The Cardea Group, LLC, a management consulting business, since May 2014 |

| l | Ms. Hudson served as CEO Emeritus of BAE, a U.S.-based subsidiary of BAE Systems, a global defense, aerospace, and security company headquartered in London, from February 2014 to May 2014, and as President and Chief Executive Officer of BAE from October 2009 until January 2014 |

| l | Ms. Hudson served as President of BAE Systems’ Land and Armaments operating group, the world’s largest military vehicle and equipment business, from October 2006 to October 2009 |

| l | Prior to joining BAE, Ms. Hudson worked at General Dynamics Corporation and was President of its Armament and Technical Products business. During her career, she has held various positions in engineering, production operations, program management, and business development for defense and aerospace companies |

| l | She served as a member of the Executive Committee and as an executive director of BAE Systems from 2009 until January 2014. She also served as a member of the Board of Directors of BAE from 2009 to April 2015 |

| l | As a director of The Southern Company, Ms. Hudson is a member of the Nuclear/Operations Committee and its Business Security Subcommittee |

Other Leadership Experience and Service:

| l | Ms. Hudson is a member of the Board of Directors of the University of Florida Foundation, Inc. and the University of Florida Engineering Leadership Institute, and a member of the Charlotte Center Executive Board for the Wake Forest University School of Business |

| l | She also is a member of the Board of Directors of the Center for a New American Security, a non-partisan research institute that develops national security and defense policies |

BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT | 7 |

PROPOSAL 1: ELECTING DIRECTORS

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As the former Chairman and Chief Executive Officer of ImpreMedia LLC (ImpreMedia), a leading Hispanic news and information company, Ms. Lozano provided broad leadership management over areas such asoperations, marketing, and strategic planning. Ms. Lozano has adeep understanding of issues that are importantto the Hispanic community, a growing U.S. demographic |

| l | Her public company board service for The Walt Disney Company and her roles with the University of California and the University of Southern California give her board-level experience overseeing large organizations with diversified operations on matters such asgovernance, executive compensation, risk management, and financial reporting |

| l | Ms. Lozano’s experience as a member of President Obama’s Council on Jobs and Competitiveness also gives hervaluable perspective on important public policy, societal, and economic issues relevant to our company |

Professional Highlights:

| l | Ms. Lozano served as Chair of the Board of US Hispanic Media Inc., the parent company of ImpreMedia, from June 2014 to January 2016. For ImpreMedia, she served as Chairman from July 2012 to January 2016 and served as Chief Executive Officer from May 2010 to May 2014. She was also Senior Vice President of ImpreMedia from January 2004 to May 2010 |

| l | Ms. Lozano served as Publisher of La Opinion, a subsidiary of ImpreMedia and the leading Spanish-language daily newspaper in the country, reaching 2 million readers monthly in print and online, from 2004 to May 2014, and was Chief Executive Officer from 2004 to July 2012 |

Other Leadership Experience and Service:

| l | She served as a member of President Obama’s Council on Jobs and Competitiveness from 2011 to 2012 and served on President Obama’s Economic Recovery Advisory Board from 2009 to 2011 |

| l | Ms. Lozano serves as a member of the Board of Regents of the University of California and a member of the US Partnership on Mobility from Poverty, and served as a member of the Board of Trustees of the University of Southern California and as a member of the State of California Commission on the 21st Century Economy |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As Chairman, President, and Chief Executive Officer of Eversource Energy, Mr. May has experience with regulated businesses, operations, risk management, business development, strategic planning, and corporate governance matters, which gives him insight into the issues facing our company’s businesses |

| l | Having experience as a Certified Public Accountant, Mr. May brings strong accounting and financial skills, and a professional perspective onfinancial reportingand enterprise and operational risk management |

Professional Highlights:

| l | Mr. May became President and Chief Executive Officer of Eversource Energy, one of the nation’s largest utilities, serving 3.6 million customers in three states, in April 2012, and has been Chairman since October 2013 |

| l | He was the Chairman and Chief Executive Officer of NSTAR, which merged with Northeast Utilities (now known as Eversource Energy), from 1999 to April 2012, and was President from 2002 to April 2012. He also served as Chief Financial Officer and Chief Operating Officer during his tenure at NSTAR |

| l | Mr. May currently serves as a director of Liberty Mutual Holding Company, Inc. |

8 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

PROPOSAL 1: ELECTING DIRECTORS

BACKGROUNDQUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As our Chief Executive Officer, Mr. Moynihan hasled the transformation of our company by rebuilding capital and liquidity, streamlining and simplifying our business model to focus on three core customer and client groups, divesting non-core businesses and products, resolving mortgage-related issues from the financial crisis, and reducing core expenses |

| l | Mr. Moynihan hasdemonstrated leadership qualities, management capability, knowledge of our business and industry, and a long-term strategic perspective |

| l | In addition, he has many years ofbroad international and domestic financial services experience, including wholesale and retail businesses |

Professional Highlights:

| l | Mr. Moynihan was appointed Chairman of the Board of Bank of America Corporation in October 2014 and President and Chief Executive Officer in January 2010. Prior to becoming Chief Executive Officer, Mr. Moynihan ran each of our company’s operating units |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As former Treasurer of PepsiCo, Inc. (Pepsi), Mr. Nowell hasstrong financial expertise andextensive global perspective in risk management and strategic planning |

| l | Through his public company board service, he has experience ingovernance, financial reporting, and accounting with large international and regulated businesses |

| l | Mr. Nowell’s experience on the advisory board at a large, public university provides him with furtherexperience with large, complex organizations |

Professional Highlights:

| l | Mr. Nowell served as Senior Vice President and Treasurer of Pepsi, a leading global food, snack, and beverage company, from 2001 to May 2009. He previously served as Chief Financial Officer of The Pepsi Bottling Group and as Controller of Pepsi |

| l | Prior to joining Pepsi, Mr. Nowell served as Senior Vice President, Strategy and Business Development at RJR Nabisco, Inc. from 1998 to 1999 |

| l | He held various senior financial roles at the Pillsbury division of Diageo Plc, including Chief Financial Officer of its Pillsbury North America, Pillsbury Foodservice, and Haagen-Dazs divisions, and also served as Controller and Vice President of Internal Audit of the Pillsbury Company |

Other Leadership Experience and Service:

| l | Mr. Nowell serves on the Dean’s Advisory Council at The Ohio State University Fisher College of Business |

BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT | 9 |

PROPOSAL 1: ELECTING DIRECTORS

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | Mr. Woods’s career at Canadian Imperial Bank of Commerce (CIBC) provides him with deep experience inrisk management, corporate strategy, finance, and thecorporate and investment banking businesses |

| l | As Senior Executive Vice President (SEVP) and Chief Risk Officer of CIBC during the financial crisis, Mr. Woodsfocused on risk management and CIBC’srisk culture |

| l | Mr. Woods chaired CIBC’s Asset Liability Committee, served as CIBC’slead liaison with regulators, and was an active member of CIBC’sbusiness strategy group |

Professional Highlights:

| l | Mr. Woods served as a Vice Chairman and SEVP of CIBC, a leading Canada-based global financial institution, from July 2013 until his retirement in December 2014 |

| l | He served as SEVP and Chief Risk Officer of CIBC from 2008 to July 2013, and SEVP and Chief Financial Officer of CIBC from 2000 to 2008 |

| l | Mr. Woods joined Wood Gundy, a CIBC predecessor firm, in 1977. During his tenure, Mr. Woods served in various senior leadership positions, including as Controller of CIBC, as CFO of CIBC World Markets (CIBC’s investment banking division), and as the Head of CIBC’s Canadian Corporate Banking division |

Other Leadership Experience and Service:

| l | Mr. Woods serves as a member of the boards of DBRS Limited and DBRS Inc., an international credit rating agency, and previously served as a member of the board of TMX Group Inc., a Canada-based financial services company, from 2012 to 2014 |

| l | He serves on the board of advisors of the University of Toronto’s Department of Mechanical and Industrial Engineering |

| l | Mr. Woods also serves as a member of the board of Alberta Investment Management Corporation (AIMCo), a Canadian institutional investment fund manager, and on the investment committee of Cordiant Capital Inc., a fund manager specializing in emerging markets |

QUALIFICATIONS, ATTRIBUTES, AND SKILLS:

| l | As the former Chief Executive Officer of AmerisourceBergen Corporation (AmerisourceBergen) and its predecessor company, Mr. Yost has broad experience instrategic planning, risk management, and operational risk. Mr. Yost has experience leading a large, complex business |

| l | Through his service on public company boards, he has board-levelexperience overseeing large, complex public companies in various industries, which provides him with valuable insights oncorporate governance and risk management |

Professional Highlights:

| l | Mr. Yost served as Chief Executive Officer of AmerisourceBergen, a pharmaceutical services company providing drug distribution and related services to healthcare providers and pharmaceutical manufacturers, from 2001 until his retirement in July 2011, and as President from 2001 to 2002 and again from September 2007 to November 2010 |

| l | He has held various positions at AmerisourceBergen and its predecessor companies during a nearly 40-year career, including Chief Executive Officer from 1997 to 2001 and Chairman from 2000 to 2001 of Amerisource Health Corporation |

10 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

CORPORATE GOVERNANCE

OUR BOARD OF THE PROPOSALDIRECTORS

Our Board is responsible for overseeing our company’s management. Our Board and its committees oversee:

| l | management’s identification, measurement, monitoring, and control of our company’s material risks, including operational, credit, market, liquidity, compliance, strategic, and reputational risks |

| l | our company’s maintenance of high ethical standards and effective policies and practices to protect our reputation, assets, and business |

| l | management’s development and implementation of an annual financial operating plan and a multi-year strategic business plan, and our progress meeting these financial and strategic plans |

| l | our corporate audit function, our independent registered public accounting firm, and the integrity of our consolidated financial statements |

| l | our company’s establishment, maintenance, and administration of appropriately designed compensation programs and plans |

Our Board is also responsible for:

| l | reviewing, monitoring, and approving succession plans for its Chairman and Lead Independent Director, and for our CEO and other key executives to promote senior management continuity |

| l | conducting an annual self-evaluation of our Board and its committees |

| l | identifying and evaluating director candidates and nominating qualified individuals for election to serve on our Board |

| l | reviewing our CEO’s performance and approving the total annual compensation for our CEO and other executive officers |

The New York Stock Exchange (NYSE) listing standards require a majority of our directors and each member of our Audit, Compensation and Benefits, and Corporate Governance Committees to be independent. The Federal Reserve Board’s Enhanced Prudential Standards require the chair of our Enterprise Risk Committee to be independent. In addition, our Corporate Governance Guidelines require a substantial majority of our directors to be independent. Our Board has adopted Director Independence Categorical Standards (Categorical Standards), published on our website athttp://investor.bankofamerica.com, to assist it in determining each director’s independence. Our Board considers a director “independent” if he or she meets the criteria for independence in both the NYSE listing standards and our Categorical Standards.

In early 2016, our Board, in coordination with our Corporate Governance Committee, evaluated the relevant relationships between each director nominee (and his or her immediate family members and affiliates) and Bank of America Corporation and its subsidiaries and affirmatively determined that all of our director nominees are independent, except for Mr. Moynihan due to his employment by our company. Specifically, the following 12 of our 13 director nominees are independent under the NYSE listing standards and our Categorical Standards: Ms. Allen, Ms. Bies, Mr. Bovender, Mr. Bramble, Mr. de Weck, Mr. Donald, Ms. Hudson, Ms. Lozano, Mr. May, Mr. Nowell, Mr. Woods, and Mr. Yost. In addition, in 2015 our Board affirmatively determined that our former directors Charles O. Holliday, Jr. and Clayton S. Rose were independent under the NYSE listing standards and our Categorical Standards prior to their retirement from our Board at our 2015 annual meeting. Mr. Gifford, who will retire as a director at the annual meeting, is not an independent director. He is a former Chairman of Bank of America Corporation and receives office space and secretarial support from our company with an aggregate incremental cost exceeding the thresholds of the NYSE listing standards and our Categorical Standards.

BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT | 11 |

CORPORATE GOVERNANCE

In making its independence determinations, our Board considered the following ordinary course, non-preferential relationships that existed during the preceding three years and determined that none of the relationships constituted a material relationship between the applicable director or nominee and our company:

| l | Our company or its subsidiaries provided ordinary course financial products and services to all of our directors. Our company or its subsidiaries also provided ordinary course financial products and services to some of their immediate family members and entities affiliated with some of our directors or their immediate family members (Mr. Donald, Mr. May, and Dr. Rose). In each case, the fees we received for these products and services were below the thresholds of the NYSE listing standards and our Categorical Standards, and were less than 2% of the consolidated gross annual revenues of our company and of the other entity |

| l | Our company or its subsidiaries purchased products or services in the ordinary course from entities where some of our directors or our director nominees are executive officers or employees or their immediate family members serve as executive officers (Mr. Donald, Mr. May, Mr. Woods, and Dr. Rose). In each case, the fees paid to each of these entities were below the thresholds of the NYSE listing standards and our Categorical Standards |

Under our Board’s current leadership structure, we have an executive Chairman and a Lead Independent Director. Our Lead Independent Director is empowered with robust, well-defined duties. Our Board is composed of experienced and committed independent directors (with all non-management nominees being independent), and our Board committees have strong, experienced chairs and members. Our Board believes that these factors, taken together, provide for strong, independent Board leadership, and effective engagement with and oversight of management.

Our Board is committed to strong, independent leadership for our Board and its committees. Our Board views the independent, objective oversight of management as central to effective Board governance, and to serving the best interests of our company and our stockholders. This commitment is reflected in our company’s governing documents, our Bylaws, and Corporate Governance Guidelines.

Our Board believes that its optimal leadership structure can and should change over time to reflect our company’s evolving needs, strategy, and operating environment; changes in our Board’s composition and leadership needs; and other factors, including the perspectives of stockholders and other stakeholders. In accordance with a 2014 amendment to our Bylaws, which our stockholders ratified at a special meeting in 2015, our Board has the flexibility to determine the Board leadership structure best suited to the circumstances of our company and our Board.

At least annually, our Board, in coordination with our Corporate Governance Committee, deliberates on and discusses the appropriate Board leadership structure, including the considerations described above. Based on that assessment and input from stockholders, our Board believes that the existing structure, with Mr. Moynihan as executive Chairman and Mr. Bovender as Lead Independent Director, is the optimal leadership framework at this time. As a highly regulated global financial services company, we benefit from an executive Chairman with deep experience in and knowledge of the financial services industry, our company, and its businesses, and a Lead Independent Director with robust, well-defined duties. Our Lead Independent Director, together with the other independent directors, instills objective independent Board leadership, and effectively engages and oversees management.

Our Board unanimously elected Mr. Moynihan as Chairman of our Board based on his leadership qualities, management capability, knowledge of the business and industry, and the long-term, strategic perspective he has demonstrated as CEO for the past five years, and in running our company’s operating units in previous years. Mr. Moynihan has led the transformation of our company out of the financial crisis and is focused on driving growth. The independent directors unanimously elected Mr. Bovender as Lead Independent Director. As the former chairman, chief executive officer, and chief operating officer of a complex, highly regulated company, Mr. Bovender has the qualities and experience the independent directors desired for a Lead Independent Director—high personal integrity, a breadth of knowledge in management, operations, and corporate governance, and a willingness to engage management. The independent directors believe Mr. Bovender, as Lead Independent Director, effectively leads the Board’s management oversight responsibilities.

12 | BANK OF AMERICA CORPORATION | 2016 PROXY STATEMENT |

CORPORATE GOVERNANCE

OCTOBER 1, 2014 CORPORATE GOVERNANCE GUIDELINES AMENDMENTRobust and Well-defined Lead Director Duties

In tandem with adopting the Bylaw Amendment, on October 1, 2014, the Board amended the company’sOur Corporate Governance Guidelines (the “Governance Guidelines Amendment”), to (a) require that a Lead Independent Director be elected by a majority ofestablish robust and well-defined duties for the independent directors (to serve a minimum one year term) when the Chairman of the Board is not independent and (b) codify an expansive set of duties and responsibilities that will be fulfilled by an independent director leading thewho leads our Board, regardless of whether that individualindividual’s title is an independent Chairman of the Board or Lead Independent Director. Our Board’s support of the current leadership structure is premised on these duties being transparently disclosed and comprehensive in nature, extending well beyond those of a traditional lead director.

The articulated Lead Independent Director duties do not fully capture Mr. Bovender’s active role in serving as our independent directors’ Board leader. For example, Mr. Bovender holds monthly calls with our primary bank regulators to discuss any issues of concern. He regularly speaks with Mr. Moynihan and holds bi-weekly calls to discuss Board meeting agendas and discussion topics, schedules, and other Board governance matters. He is a member of the Corporate Governance Committee and he also attends meetings of all of the other Board committees. He speaks with each Board member at least quarterly to receive input on Board agendas, Board planning matters, and other related topics of management oversight. He also meets at least quarterly with management members, including the Chief Administrative Officer, Chief Financial Officer, Chief Risk Officer, Global Compliance Executive, and Global Human Resources Executive. Mr. Bovender also plays a leading role in our stockholder engagement process, representing our Board and independent directors in investor meetings. In 2015 and early 2016, Mr. Bovender met with many of our largest stockholders, often in person; in aggregate, Mr. Bovender met with investors who own approximately 28% of our outstanding shares.

Duties of the Lead Independent Director including the following:or Independent Chairman

Board Leadership

In the case of the Chairman, presiding at all meetings of our Board and, in the case of the Lead Independent Director, presiding at all meetings of our Board at which the Chairman is not present, including at executive sessions of the independent directors |

Calling meetings of the independent directors, as appropriate |

In the case of the Lead Independent Director, if the CEO of our company is also Chairman, providing Board leadership if the CEO/Chairman’s role may be (or may be perceived to be) in conflict |

Board Culture

Serving as a liaison between the CEO and the independent directors |